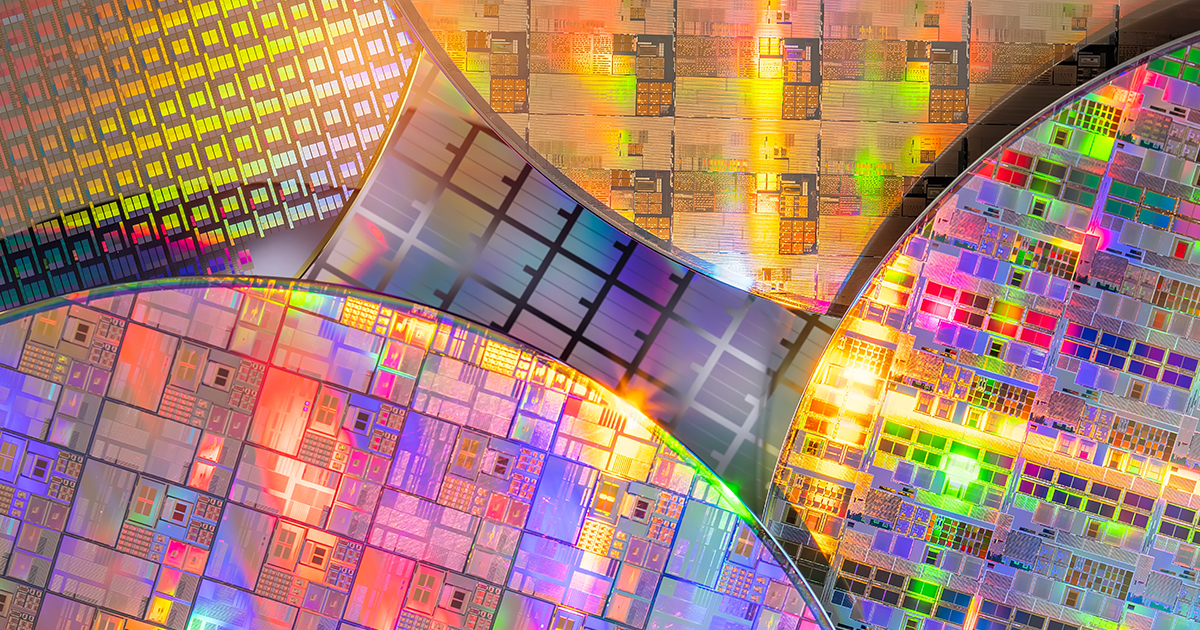

Once the undisputed king of the semiconductor world, Intel is now embarking on its most audacious transformation in decades. The company that long prided itself on designing and manufacturing its own chips is throwing open the doors to its advanced factories, aiming to become a world-class foundry for a diverse range of customers, including its fiercest rivals. This strategic pivot, dubbed IDM 2.0, is a high-stakes bet to reclaim technological leadership, navigate the shifting sands of global supply chains, and redefine Intel’s very identity.

For years, Intel’s integrated device manufacturing (IDM) model was the bedrock of its dominance. It was a vertically integrated fortress, where cutting-edge chip designs were inextricably linked to a network of world-beating foundries. But a series of uncharacteristic manufacturing stumbles saw the silicon giant lose its process leadership to rivals like TSMC and Samsung. This, coupled with the meteoric rise of fabless semiconductor companies—brilliant designers who outsource the costly business of manufacturing—left Intel at a critical juncture.

Enter Intel Foundry, a dedicated business unit and a clear declaration of intent. The goal is ambitious: to become the world’s second-largest foundry by 2030. To achieve this, Intel is not just investing billions in new and expanded fabrication plants (fabs) across the globe, but is also orchestrating a profound cultural shift from a product-centric company to a customer-service-oriented partner.

A Roadmap to Reclaim the Throne

At the heart of Intel’s foundry ambition lies a meticulously crafted technology roadmap. The company is aggressively pushing the boundaries of silicon with a “five nodes in four years” strategy, a blistering pace of innovation designed to leapfrog the competition. All eyes are on Intel 18A, a process technology slated for readiness in the second half of 2024, which the company confidently proclaims will mark its return to process leadership.

Intel 18A is not just an incremental improvement. It boasts two groundbreaking technologies: RibbonFET, an evolution of the FinFET transistor architecture that promises better performance and power efficiency, and PowerVia, a novel backside power delivery network that optimizes signal integrity and opens the door for denser and more powerful chip designs. Beyond 18A, the roadmap already extends to Intel 14A, signaling a long-term commitment to the leading edge.

More Than Just Wafers: The Advanced Packaging Advantage

In the modern era of chip design, the game is no longer just about shrinking transistors. As Moore’s Law slows, advanced packaging has emerged as a critical frontier for performance gains. This is where Intel believes it has a trump card. Its Foveros 3D stacking technology allows for the vertical integration of different chiplets, enabling the creation of complex, high-performance systems-on-a-chip. Imagine stacking high-speed memory directly on top of a processor for unprecedented bandwidth.

Complementing Foveros is EMIB (Embedded Multi-die Interconnect Bridge), a high-density 2.5D packaging technology that allows for the seamless connection of multiple dies on a single substrate. Recent innovations like EMIB-T are pushing the boundaries even further, enabling larger and more complex chip packages. These technologies offer customers a powerful toolkit to mix and match different process nodes and IP blocks, fostering a new era of design flexibility and innovation.

Building an Ecosystem of Trust and Collaboration

Becoming a successful foundry requires more than just state-of-the-art technology; it demands an ecosystem built on trust and collaboration. Intel is actively courting a broad range of customers and has already secured a significant win with Microsoft, which will be using the 18A process. The company has announced a lifetime deal value of over $15 billion for its foundry business, a testament to the growing confidence in its capabilities.

Furthermore, Intel is fostering deep partnerships with key players in the electronic design automation (EDA) and IP space, including industry giants like Synopsys, Cadence, and Siemens EDA. These collaborations are crucial to ensure that customers have the tools and support they need to design and verify their chips on Intel’s processes.

The Mountain to Climb: Challenges on the Horizon

Despite the bold strategy and technological prowess, Intel’s path to foundry success is fraught with challenges. The foundry market is dominated by the formidable duo of TSMC and Samsung, who have decades of experience serving a diverse customer base and have built deeply entrenched relationships.

Intel must also overcome its own legacy. For years, its fabs were exclusively tuned for its own high-margin products. Shifting to a foundry model requires a fundamental change in mindset, prioritizing customer needs and production flexibility. Execution will be paramount. Any delays in its ambitious roadmap could erode customer confidence and give competitors further ground.

A Geopolitical Tailwind

Fueling Intel’s foundry ambitions is a significant geopolitical tailwind. The recent global chip shortage and increasing trade tensions have highlighted the strategic importance of a resilient and geographically diverse semiconductor supply chain. Governments around the world, particularly in the United States and Europe, are offering substantial incentives, such as the US CHIPS Act, to encourage domestic chip manufacturing. Intel, with its significant manufacturing footprint in the West, is a primary beneficiary of these initiatives.

The Final Verdict: A Bet on the Future

Intel’s push into the foundry business is more than just a new revenue stream; it’s a fundamental reimagining of the company’s role in the semiconductor industry. It’s a bold and necessary gamble to secure its relevance and leadership in an increasingly competitive landscape. The road ahead is undoubtedly challenging, but with a clear strategy, cutting-edge technology, and the winds of geopolitics at its back, Intel may just have what it takes to forge a new future and once again become the bedrock of the digital world. The entire tech industry will be watching to see if this silicon giant can indeed build its way back to the top.